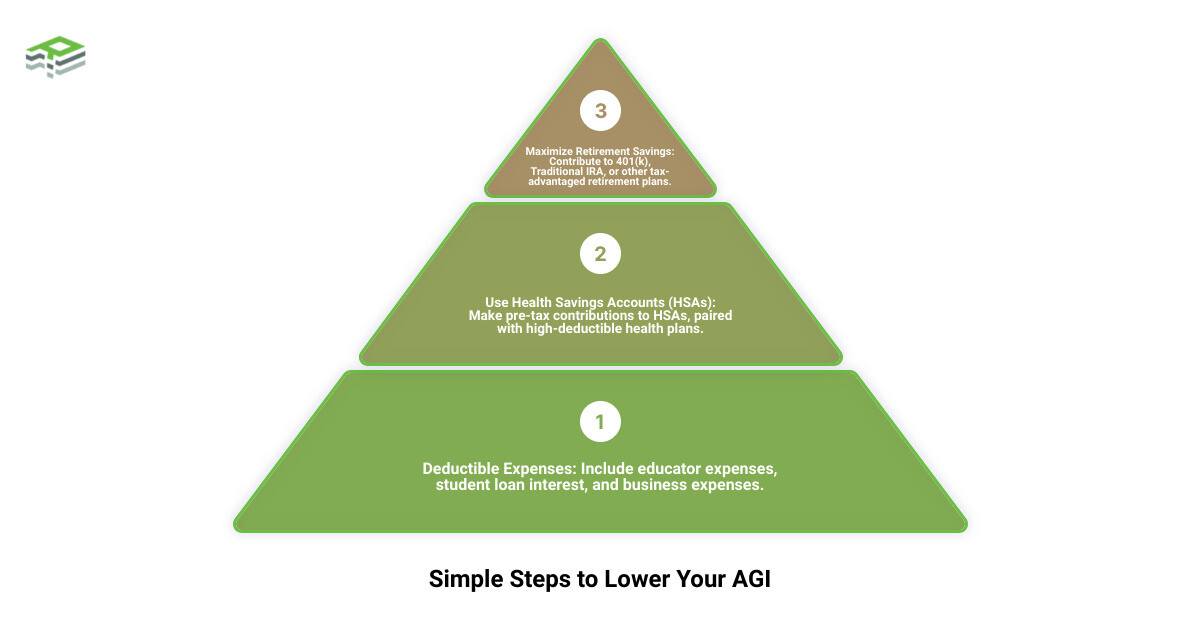

Quick Guide to Lowering Your AGI:

- Maximize Retirement Savings: Contribute to 401(k), Traditional IRA, or other plans.

- Use Health Savings Accounts (HSAs): Make pre-tax contributions.

- Deductible Expenses: Don’t forget educator expenses, student loan interest, and business expenses.

- Tax Credits and Deductions: Look for Saver’s Credit, Adoption Tax Credit, etc.

- Invest Smart: Use 529 Plans and understand capital gains.

When you hear “Adjusted Gross Income” or AGI, you might wonder why it’s so important. Simply put, your AGI is a key number that affects how much tax you pay. The lower your AGI, the less you might owe the IRS. For small to medium-sized business owners and individuals, understanding and reducing your AGI can lead to meaningful savings, ensuring more of your hard-earned money supports your goals, not just your tax bill.

Reducing your AGI can seem daunting, but it’s essentially about making smart financial moves: saving for retirement, using certain accounts for health expenses, and knowing which expenses you can deduct. By taking these steps, you can potentially lower your taxable income and thus, your taxes.

Why Lower Your AGI? Beyond saving on taxes, lowering your AGI could make you eligible for more tax credits and deductions. This not only impacts your current financial health but sets a solid foundation for your future.

For a quick and easy reference on lowering your AGI, check out the infographic below.

There’s no one-size-fits-all strategy. Your financial situation is unique, and what works for one person might not be the best for another.

Now, let’s dive deeper.

Maximize Retirement Contributions

When looking at how to lower your AGI, one of the most effective strategies is to maximize your contributions to retirement accounts. This approach not only helps in building a nest egg for your future but also significantly reduces your taxable income now. Let’s break down the options:

401(k) Plans

If your employer offers a 401(k) plan, contributing the maximum amount allowed can lower your AGI substantially. For 2024, the contribution limit is $23,000, with an additional $7,500 for those 50 and older. This money goes directly from your paycheck into your 401(k) before taxes are applied, reducing your taxable income.

Traditional IRA

Contributing to a Traditional IRA is another way to reduce your AGI. You can contribute up to $6,000 in 2024, or $7,000 if you’re 50 or older. These contributions may be fully or partially deductible, depending on your income and whether you or your spouse are covered by a retirement plan at work.

SEP and SIMPLE Plans

For the self-employed or small business owners, SEP (Simplified Employee Pension) and SIMPLE (Savings Incentive Match Plan for Employees) IRAs offer higher contribution limits and the opportunity to lower AGI. SEPs allow contributions of up to 25% of compensation or $66,000 in 2024, whichever is less. SIMPLE plans have a lower limit, but still offer a good opportunity to save and reduce taxable income.

Qualified Plans

Other qualified plans, like 403(b)s for nonprofit employees or 457 plans for government workers, also offer tax-advantaged saving opportunities. Contributing to these plans reduces your AGI and helps secure your financial future.

Case Study: John, a graphic designer, switched from being a full-time employee to a freelance consultant. He learned he could contribute to a SEP IRA, allowing him a higher contribution limit than the 401(k) he had with his previous employer. By maximizing his SEP IRA contributions, John not only prepared for his retirement but also reduced his taxable income, lowering his tax bill significantly.

Remember: The key to maximizing these benefits is to start early in the year and contribute as much as you can afford, up to the limit. Early contributions also benefit from more time to grow, compounding the savings and investment growth over time.

By understanding and utilizing these retirement saving options, you can lower your AGI, save on taxes, and build a more secure financial future. Each option has its own set of rules and limits, so choose the one that best fits your income level and retirement goals.

Now that we’ve covered how to use retirement contributions to lower your AGI, let’s explore how health savings accounts can further reduce your taxable income and provide financial benefits.

Leverage Health Savings Accounts

Health Savings Accounts (HSAs) are a powerful tool for anyone looking to lower their AGI. Not only do they offer triple tax advantages, but they also help you save for future medical expenses. Here’s how you can use HSAs to your benefit:

HSA Contributions

When you contribute to an HSA, that money is deducted from your taxable income, which directly lowers your AGI. For 2023, you can contribute up to $3,850 for individual coverage or up to $7,750 for family coverage. And if you’re 55 or older, you can add an extra $1,000 as a catch-up contribution.

High-Deductible Health Plans

To be eligible for an HSA, you must be enrolled in a high-deductible health plan (HDHP). These plans have lower premiums but higher deductibles, making them a good choice if you’re generally healthy and want to save on monthly costs while investing in an HSA. It’s a win-win: you save money on premiums and lower your AGI through HSA contributions.

HSAs are not just about the immediate tax benefits. Your contributions grow tax-free, and you can make tax-free withdrawals for qualified medical expenses. This means every dollar you put into your HSA works harder for you, both now and in the future.

Not everyone qualifies for an HSA, so it’s important to check with your plan administrator to see if your current health insurance plan is HSA-eligible. If it is, taking full advantage of this opportunity can be a smart move for your financial health and a strategic way to lower your AGI.

By understanding and utilizing HSAs, you’re not just saving on taxes today. You’re preparing for a healthier financial future. It’s a clear example of how strategic planning, paired with the right financial vehicles, can lead to significant savings and benefits.

As we continue to explore strategies on how to lower AGI, keep in mind that combining these methods can lead to even greater tax savings. Next, we’ll delve into how you can deduct eligible expenses and contributions to further reduce your taxable income.

Deduct Eligible Expenses and Contributions

Lowering your AGI isn’t just about what you earn but also about understanding what you can deduct. Let’s break down how certain expenses and contributions can work in your favor.

Educator Expenses

If you’re a teacher or educator, you’re in luck. You can deduct up to $300 for single filers or $600 if both spouses are eligible educators and filing jointly. This covers books, supplies, and even technology used in the classroom. Imagine buying $300 worth of supplies and effectively getting that money back at tax time. It’s a direct way to lower your AGI, and it’s a thank-you note from the tax code for your contribution to education.

Student Loan Interest

Paying off student loans? You might be able to deduct up to $2,500 of the interest paid over the year. This deduction phases out based on your income, but if you’re under the limit, it’s a straightforward way to reduce your AGI. Every little bit helps when you’re trying to minimize your tax liability.

Business Expenses

For the self-employed or small business owners, this is where you can significantly impact your AGI. Office rent, utilities, supplies, and even certain types of software can be deducted. The key here is to keep meticulous records. Every legitimate business expense you deduct directly lowers your AGI. It’s like the government is sharing in your business costs.

Alimony Payments

This one’s a bit tricky. If your divorce or separation agreement was executed before 2018, you might be able to deduct alimony payments. This can be a substantial deduction, but understand the specific rules and ensure you qualify.

Combining Strategies for Maximum Impact

The real magic happens when you combine these deductions. A teacher with a side business who’s paying off student loans and makes alimony payments could see a significant reduction in their AGI. By strategically planning and utilizing these deductions, you’re not just reducing your taxable income; you’re optimizing your financial landscape.

The goal here isn’t to manipulate the system but to understand and make the most of the benefits available to you. Every dollar you deduct is a dollar that’s not being taxed, which can lead to real savings when April rolls around.

Remember that lowering your AGI can open the door to even more tax credits and deductions. It’s a foundational strategy that can influence every aspect of your tax planning. Next, we’ll explore how utilizing specific tax credits and deductions can further reduce your tax liability and potentially increase your refund.

Utilize Tax Credits and Deductions

When it comes to lowering your AGI, don’t overlook the power of tax credits and deductions. These can significantly reduce your tax liability and, in some cases, increase your refund. Let’s dive into some key areas where you can make an impact.

Saver’s Credit

The Saver’s Credit, also known as the Retirement Savings Contributions Credit, is a way for lower to middle-income taxpayers to reduce their tax liability by saving for retirement. If you contribute to a 401(k), IRA, or another retirement plan, you may be eligible for this credit. The amount you can claim depends on your filing status and income.

Adoption Tax Credit

For those who have adopted a child, the Adoption Tax Credit can provide substantial financial relief. This credit covers adoption fees, court costs, attorney fees, traveling expenses, and other expenses related to the adoption process. The maximum amount available for the credit is subject to change each year, so stay updated.

Student Loan Interest Deduction

Paying off student loans? You might be able to deduct up to $2,500 of the interest paid on your student loans from your taxable income. This deduction is available for both federal and private student loans and can be claimed even if you don’t itemize deductions on your tax return.

Health Insurance Premiums

For self-employed individuals, health insurance premiums can also lower your AGI. You can deduct premiums you pay for medical, dental, and some long-term care insurance for yourself, your spouse, and your dependents. This deduction is taken on Form 1040, and you don’t need to itemize to claim it.

Remember: Each of these credits and deductions has specific eligibility criteria. It’s crucial to keep detailed records and consult with a tax professional if you’re unsure about your eligibility.

By strategically utilizing these tax credits and deductions, you can effectively lower your AGI and improve your overall tax situation. We’ll address some frequently asked questions about lowering AGI, providing you with a clearer understanding of how these strategies can benefit you.

Invest in Tax-Advantaged Accounts

When it comes to how to lower AGI, investing in tax-advantaged accounts is a smart move. Let’s break down some options:

529 Plans

A 529 Plan is a savings plan designed to help pay for education. The beauty of a 529 Plan is its tax benefits. While contributions to a 529 Plan are not deductible from your federal income taxes, many states offer tax deductions or credits for contributions. Plus, the earnings in a 529 Plan grow tax-free as long as they are used for qualified education expenses. This means you can lower your state taxes and potentially reduce your MAGI, indirectly affecting your AGI.

Capital Gains and Losses

Investing in the stock market or other securities? Pay attention to capital gains and losses. If you sell an investment for more than you paid, you have a capital gain. If you sell for less, you have a capital loss. Capital losses can be used to offset capital gains and up to $3,000 of other income, reducing your AGI. This strategy, known as tax-loss harvesting, can be a powerful tool in managing your tax bill.

MAGI Reduction Strategies

Some tax benefits are based on your Modified Adjusted Gross Income (MAGI). Strategies that lower your AGI can also lower your MAGI, making you eligible for more tax benefits. For example, contributing to a traditional IRA reduces your AGI and MAGI, potentially qualifying you for other tax credits and deductions.

Investing in tax-advantaged accounts not only provides financial growth opportunities but also strategic ways to manage and lower your AGI. Each option comes with its own set of rules and benefits, so it’s crucial to choose the ones that align with your financial goals and tax situation.

As we wrap up this section, lowering your AGI can lead to substantial tax savings. Whether it’s through 529 Plans, managing capital gains and losses, or understanding MAGI reduction strategies, each step you take can contribute to a lower tax bill and a more secure financial future.

In the next section, we’ll dive into some frequently asked questions about lowering AGI, giving you further insights into how you can optimize your tax situation.

Frequently Asked Questions about Lowering AGI

When it comes to managing your taxes, knowing how to lower AGI can be a powerful tool in your financial toolkit. Let’s tackle some of the most common questions people have about this topic.

Can 401(k) Contributions Reduce My AGI?

Yes, they can. When you contribute to a 401(k) plan, those contributions are made with pre-tax dollars. This means the money you put into your 401(k) is taken from your paycheck before taxes are applied. As a result, your taxable income—and therefore your AGI—is reduced by the amount of your contribution. For many, this is a straightforward way to lower their tax bill while saving for retirement.

How Does Contributing to an IRA Affect My AGI?

Contributing to a traditional IRA can also lower your AGI. Similar to 401(k) contributions, the money you put into a traditional IRA is often deductible, meaning it can reduce your taxable income for the year. However, there are income limits that determine how much of your contribution is deductible. If your income is too high, you might not get the full benefit. But for many, IRA contributions are an effective strategy to reduce AGI.

Are HSA Contributions Deductible from AGI?

Absolutely. Health Savings Account (HSA) contributions are another great way to reduce your AGI. If you have a high-deductible health plan, you’re eligible to contribute to an HSA. The money you contribute to your HSA is deductible, which means it lowers your taxable income and, by extension, your AGI. Plus, HSA funds can be used tax-free for qualified medical expenses, making HSAs a double win for lowering your AGI and managing healthcare costs.

Understanding the impact of retirement contributions, IRA investments, and HSA savings on your AGI can make a significant difference in your financial planning and tax strategy. Each of these tools not only helps in lowering your current tax liability but also plays a crucial role in your long-term financial health.

Conclusion

Navigating the complexities of tax laws and identifying opportunities to lower your AGI can seem daunting. But, it doesn’t have to be. At Rockerbox Tax Solutions, we believe in making tax planning and mitigation strategies accessible and understandable for everyone.

We’ve discussed various ways on how to lower AGI, from maximizing your retirement contributions to leveraging health savings accounts and deducting eligible expenses. These strategies are not just about reducing your tax bill; they’re about making smart financial decisions that benefit you both now and in the future.

Lowering your AGI is not just about finding loopholes. It’s about understanding how the tax system works and using that knowledge to your advantage. Whether it’s through investing in retirement accounts, making smart deductions, or utilizing tax credits, there are numerous ways to effectively manage your taxable income.

At Rockerbox Tax Solutions, we’re committed to helping you navigate these decisions. Our team of experts is equipped with the knowledge and tools to guide you through the process of lowering your AGI in a way that aligns with your financial goals. We understand that each individual’s situation is unique, and we tailor our advice to meet your specific needs.

If you’re looking for personalized tax mitigation strategies and want to learn more about how to lower your AGI, we invite you to explore our Tax Mitigation services. Let us help you make informed decisions that lead to a healthier financial future.

In conclusion, lowering your AGI is a powerful strategy for reducing your tax liability and enhancing your financial well-being. With the right approach and guidance, you can take control of your taxes and pave the way for a more secure financial future. Let Rockerbox Tax Solutions be your partner in this journey, providing the expertise and support you need to navigate the complexities of tax planning with confidence.